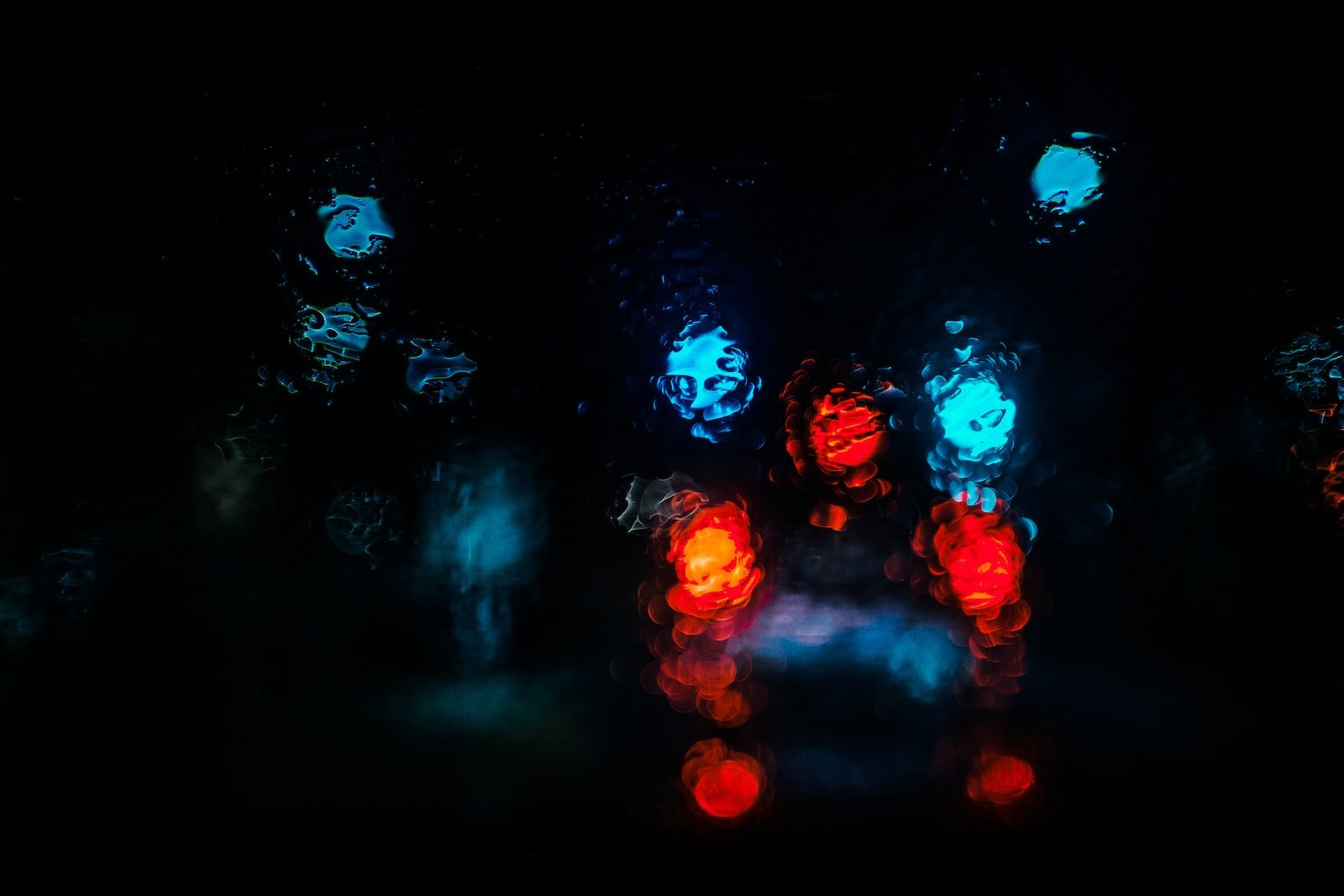

Life is full of surprises, and sometimes unexpected expenses can pop up out of nowhere. That’s why it’s important to have an emergency fund – a stash of money set aside for those unexpected rainy days.

Common Emergencies to Save For with a Rainy-Day Fund

An emergency fund is an important tool for staying financially prepared for unexpected situations. But what kind of emergencies should you save for? Here are some common types of emergencies that you might need a rainy day fund for:

- Medical Emergencies: If you or a family member gets sick or injured, medical bills can add up quickly. Having an emergency fund can help you cover these unexpected expenses.

- Car Repairs: Cars can break down at any time, and repairs can be expensive. Having a rainy day fund can help you cover the cost of unexpected car repairs.

- Home Repairs: Just like cars, homes also require maintenance and repairs. A leaky roof, broken appliance, or other home repair can be costly, but having an emergency fund can help you handle these expenses.

- Job Loss: Losing your job can be a difficult and stressful experience. With an emergency fund, you can help cover your expenses while you look for a new job.

- Natural Disasters: Hurricanes, floods, and other natural disasters can cause extensive damage to homes and property. An emergency fund can help cover the cost of repairs or relocation.

How can you build an emergency fund?

Here are some tips for kids on how to build an emergency fund:

- Start small. You don’t need to save a lot of money all at once. Start with small amounts and gradually increase your savings over time.

- Set a savings goal. Determine how much you want to save and when you want to have it saved by. This will help you stay motivated and on track.

- Cut back on spending. Look for ways to save money by cutting back on unnecessary expenses. For example, you could pack your lunch instead of buying it, or find free entertainment options instead of paying for movies or video games.

- Make saving a habit. Set up a regular savings plan, such as saving a portion of your allowance or birthday money each month. You can also save any spare change or extra money you earn from doing chores.

- Use a savings account. Keep your emergency fund in a separate savings account, so you’re not tempted to spend it on other things. This will also help your money grow over time, thanks to interest.

Remember, building an emergency fund takes time and discipline. But with these tips, you can start saving for a rainy day and be prepared for whatever surprises life may throw your way.